How to Save More Money Every Month in Nigeria – Even With Unstable Income

July 10 2025

5 Mins READ

Damilola

948

How to Save More Money Every Month in Nigeria Even With Unstable Income

Saving money in Nigeria can feel like an impossible task, especially when your income is unpredictable. With rising living costs, fluctuating earnings, and economic uncertainty, many people struggle to set aside money consistently. But the truth is, saving is possible, even with an unstable income.

In this guide, we’ll explore practical, realistic strategies to help you save more money every month, no matter how irregular your earnings are.

1. Track Every Naira You Earn and Spend

The first step to saving money is knowing where your money is going. Keep track of every source of income and every expense. Use simple apps like Money Manager, Spendee, or even a notebook to write down:

- How much you earn weekly or monthly?

- How much you spend on essentials like food, transport, and bills?

- How much you spend on non-essentials?

When you see your spending patterns clearly, you can start making smarter choices.

2. Create a Flexible Budget

With unstable income, a strict budget may not work. Instead, create a flexible budget that covers:

- Your basic needs (food, rent, transport)

- Emergency savings

- Optional expenses (entertainment, shopping)

Base your spending on your average monthly income or your lowest expected income. When you earn more, save the extra. This approach helps you stay consistent even during low-earning months.

3. Build an Emergency Fund First

Saving for emergencies is crucial when your income fluctuates. Aim to set aside at least 10% of any income you receive, no matter how small. Start small and increase the amount gradually.

Emergency funds protect you from debt and reduce financial stress when unexpected expenses arise.

4. Cut Unnecessary Expenses

Review your spending and identify expenses you can reduce or eliminate. Common areas to cut back include:

- Eating out frequently

- Unnecessary subscriptions

- Impulse shopping

Small changes in daily habits can lead to significant savings over time.

5. Maximize What You Already Have

Before making new purchases, ask yourself: Do I really need this? Can I use something I already own, or find a smarter way to get it?

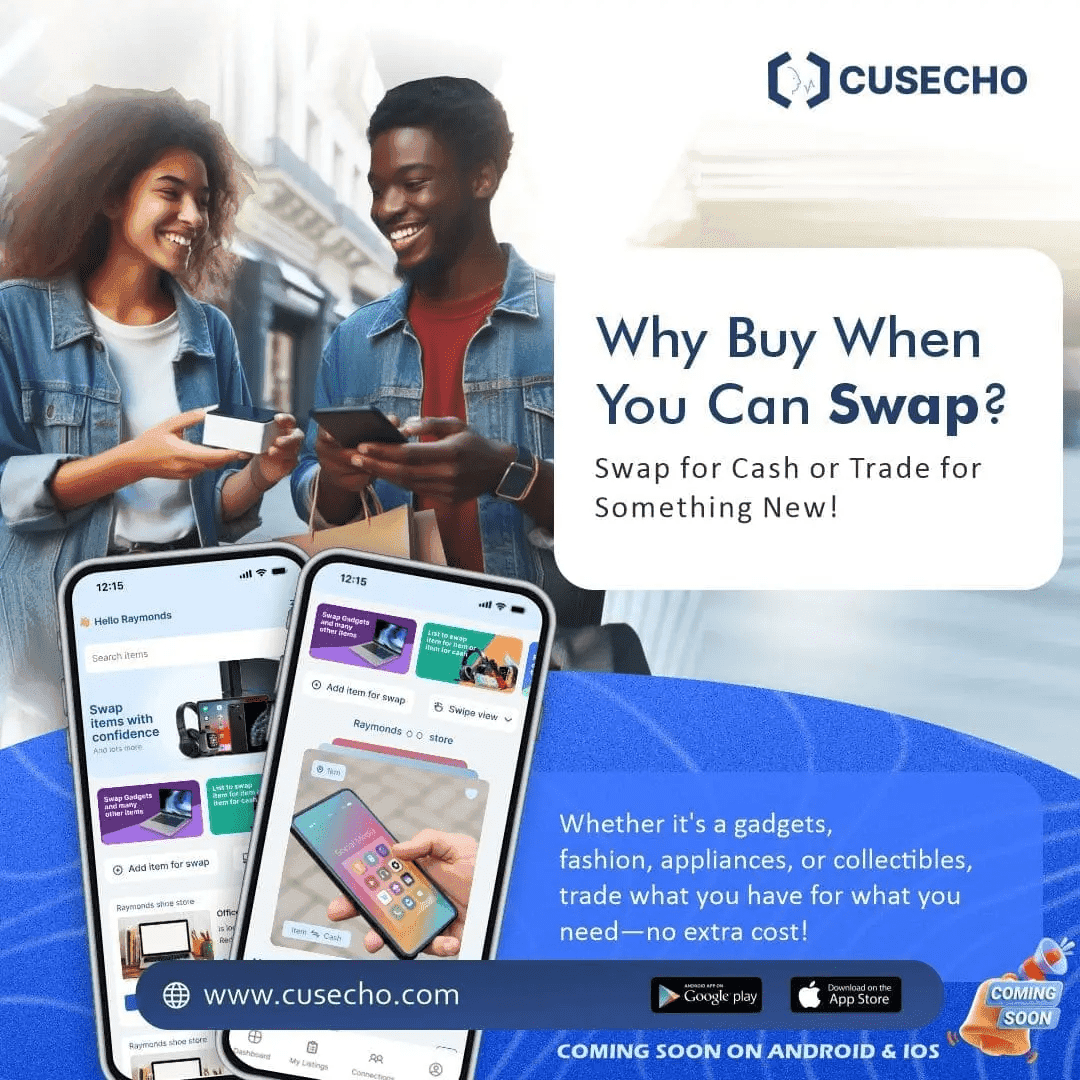

One way Nigerians are saving money is by swapping items they no longer use for things they need. Platforms like Cusecho allow users to exchange items such as electronics, fashion, and household goods without spending cash.

By swapping instead of buying, you can save money while still getting value from unused items.

6. Increase Your Income with Side Hustles

While cutting expenses helps, increasing your income can accelerate your savings. Consider starting a side hustle like:

- Freelance writing or design

- Selling products online

- Virtual assistance

- Online tutoring

Look for opportunities that match your skills and allow you to earn extra income part-time.

7. Automate Your Savings

Whenever you receive income, transfer a fixed amount immediately into a separate savings account. Automation helps remove the temptation to spend first and saves you the stress of manual transfers.

Many Nigerian banks and fintech apps offer automated savings plans.

8. Take Advantage of Discounts and Smart Shopping

Shop during sales, use discount codes, and compare prices before buying. Every naira saved matters. Also, consider second-hand or refurbished items when possible.

Platforms like Cusecho make it easy to find quality items affordably through swaps and deals.

In Conclusion

Saving money in Nigeria with unstable income may be challenging, but it is not impossible. With smart budgeting, disciplined habits, and creative strategies like swapping instead of spending, you can build financial security step by step.

Start small, stay consistent, and use every opportunity to maximize value. For an extra boost in savings, visit www.cusecho.com and discover how swapping can help you save more every month.

See more related